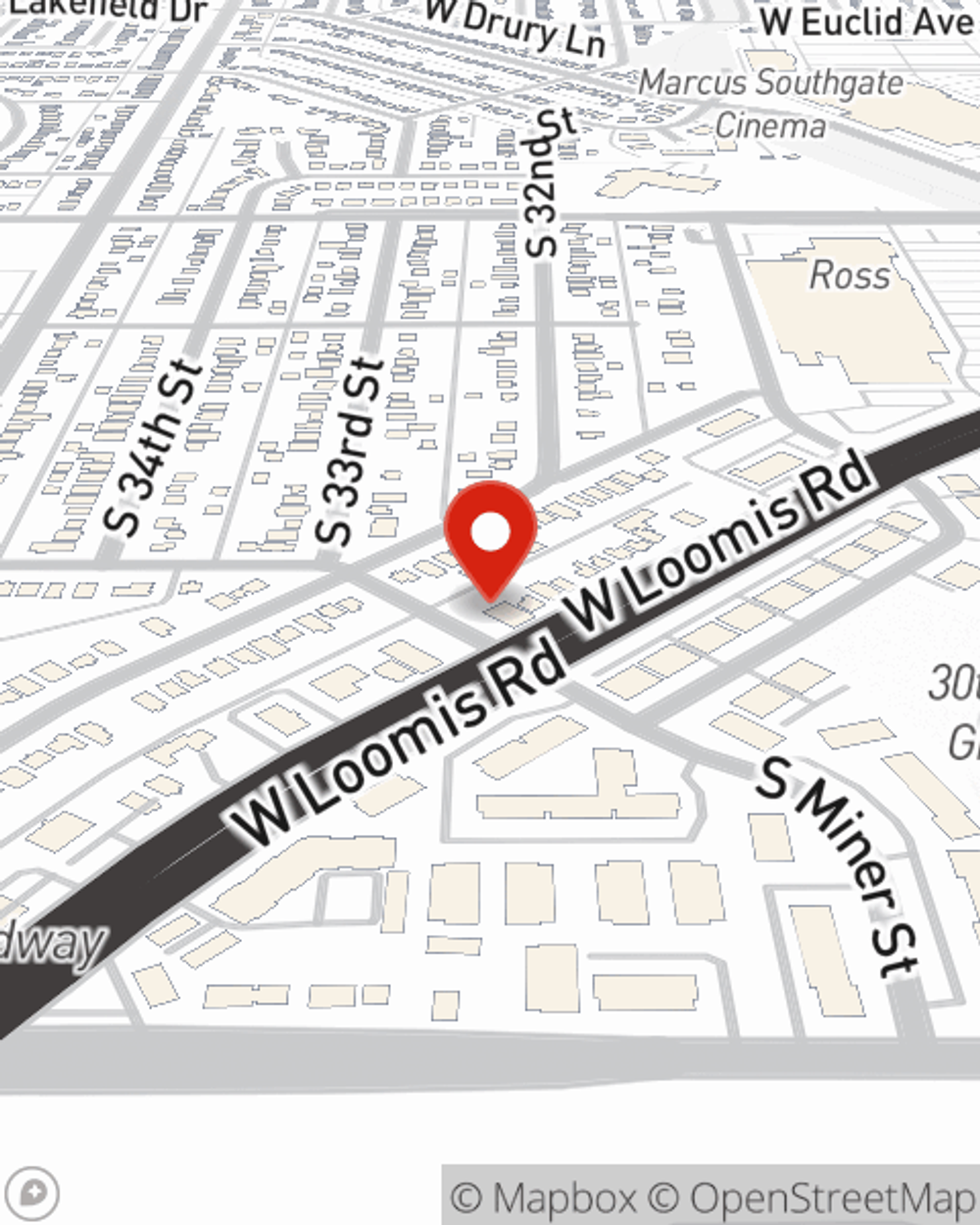

Life Insurance in and around Greenfield

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Protect Those You Love Most

Providing for those you love is an honor and a joy. You advise them on important decisions listen to their concerns, and take time to plan for the future. That includes getting the proper life insurance to care for them even if you can't be there.

Life goes on. State Farm can help cover it

Don't delay your search for Life insurance

Their Future Is Safe With State Farm

Fortunately, State Farm offers many policy choices that can be adjusted to match the needs of those most important to you and their unique situation. Agent Jon Fernandez has the personal attention and service you're looking for to help you select a policy which can assist your loved ones in the wake of loss.

State Farm offers a great option for anyone who thought they couldn't qualify for life insurance: Guaranteed Issue Final Expense. This coverage can be of good use by covering final expenses like medical bills or funeral costs, ensuring that your loved ones won't have to bear the burden. For more information, contact Jon Fernandez, your local State Farm agent and see how you can be there for your loved ones—no matter what.

Have More Questions About Life Insurance?

Call Jon at (414) 325-9440 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.

Jon Fernandez

State Farm® Insurance AgentSimple Insights®

Tips for managing life insurance after divorce

Tips for managing life insurance after divorce

Not sure how a divorce will affect your life insurance policy? Consider these tips for managing your insurance policies after divorce.

What to consider when choosing a beneficiary for life insurance or other financial accounts

What to consider when choosing a beneficiary for life insurance or other financial accounts

Learn what factors to consider when choosing a life insurance beneficiary or a beneficiary for other financial accounts.